ZERO MARGIN FEES!

This is among the absolute lowest stake pool fees

available and it ensures that you get the highest

rewards from staking your ADA.

The stake pool cluster is securely setup, is fully

automated and monitored 24/7. Whenever the needs

of running the Cardano stake pools change, our

setup will scale with the requirements.

If you were delegated to MANTIS POOL, then please if you can re-delegate again that would be appreciated! The unretirement of the pool crossed an epoch boundary resulting in the invalidation of all delegations. As a bonus, the pool is now ZERO margin!

Available Staking Pools

We invest in our infrastructure to provide a reliable, secure, and optimized staking pool experience.

All staking pools run on modern node hardware with computing resources exceeding the recommended specifications.

The MANTIS relay and core servers are located in multiple data centres

across various continents and each are provisioned with 12 CPU cores, 60 GB RAM, and 800 GB NVMe drives.

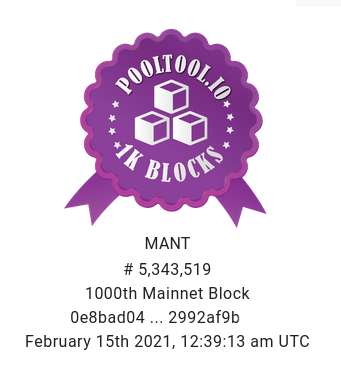

MANTIS POOL

Ticker: MANT

Our mission and commitment

to you

Our delegators are the reason we exist. Everything we do in every capacity is aimed at going above and beyond the expectations of our delegators. The best relationships are always based on trust, and we will do everything we can to earn your trust through offering the best, most consistent and reliable, staking experience in the Cardano network.

Not every Stake Pool is created equal. As an ada delegator, you deserve stake pool excellence in order to receive the most consistent and long term series of rewards. Stake with confidence knowing that we handle all of the hard geeky stuff on the technology backend. We pour our time, money, and energy into building the best stake pool available. You won't see us wasting needlessly on flashy web design or social media campaigns. We believe in our product and we know that it delivers results.

Believe in the MANTIS POOL advantage!

- Professionally run with over 30 years of IT experience.

- Here since the very beginning - Stake pool created at the the start of the Cardano Shelley era (Wednesday 29th July 2020).

- Experienced - Operated two successful pools on the HTN test net.

- 100% dedicated to the decentralization of the Cardano network.

- Long-term operating plan. Invested in node infrastructure and upgrades.

- Cloud based Linux servers located in military grade secure data centers (United States and Germany).

- 24/7 operation with 99% uptime performance.

- You maintain custody and control of your ADA at all times.

- Stake pool operators never have access to your delegated ADA.

MANTIS Pool Network - 2020-2025

mantispoolcardano@gmail.com